inheritance tax changes budget 2021

Budget 2021 - Changes to Inheritance Tax. There are also changes to be aware of if you make a capital gain or have to pay inheritance tax on someones estate.

The Silver Spoon Tax How To Strengthen Wealth Transfer Taxation Equitable Growth

Changes To Inheritance Tax for Budget 2022.

. Chancellor Rishi Sunak walking tax tightrope to balance Budget RISHI SUNAK has announced the Budget for 2021 and Inheritance Tax has featured in the announcement today. Ad Compare Your 2022 Tax Bracket vs. Tax rates and allowances.

Budget 2021 Predictions for Capital Gains Tax Inheritance Tax and Income Tax. As of January 1 under a tax increase package adopted in April 2019 House Bill 6 New Mexico has added a fifth individual income tax bracket at a new top rate of 59 percent. Previously the top rate of 49 percent kicked in at 16000 in marginal taxable income for single filers.

In a nutshell everything remains the same. Your 2021 Tax Bracket to See Whats Been Adjusted. The nil rate band will continue at 325000 the residence nil rate band will continue at 175000 and the residence nil rate band taper will continue to start at 2 million.

The Nil Rate Band NRB has not changed since 2009 and the introduction of the Residence Nil Rate Band RNRB. Rishi Sunaks second Budget of 2021 was largely about spending with little movement on personal tax - notably absent again was any mention of capital gains tax inheritance tax or pension tax. The rate of tax payable stays at 33.

Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. Therell be a 40 charge on the remaining 25000 giving a total of 10000 in tax presuming youre not leaving anything to charity. Proposed changes to Capital Gains Tax.

In 2021 Iowa passed a bill to begin phasing out its state inheritance tax eliminating. Following the announcement on 22 February 2021 there finally seems to be some light at the end of the tunnel. 27 October 2021 3 min read Share Chancellor Rishi Sunak largely resisted the temptation to tinker with pension and inheritance taxes to fund his spending plans in his Autumn Budget on Wednesday.

10 on assets 18 on property. Given the rapidly rising values in many asset classes. About any likely changes to Inheritance Tax following the Spring Budget on March 3.

Budget 2021 has been announced. As announced in the 2021 Autumn Budget many taxpayers will soon see higher tax bills for dividend income along with National Insurance hikes - despite calls for the government to call them off. Find Out What You Need To Know - See for Yourself Now.

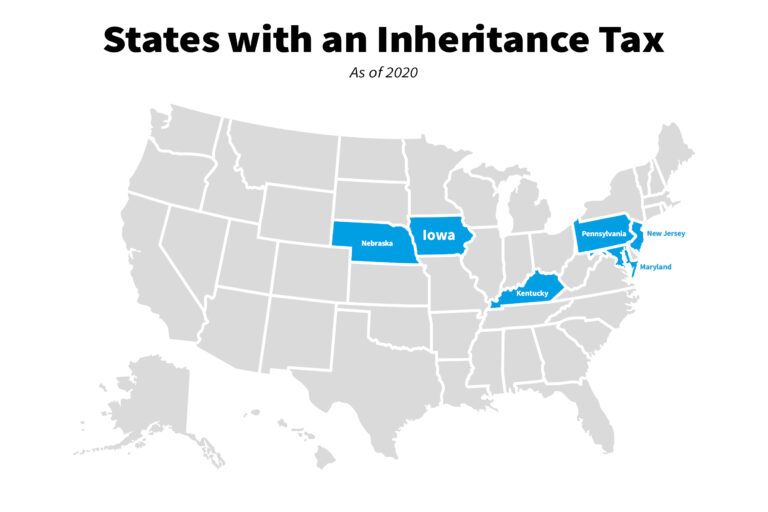

This is called entrepreneurs relief. The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

If you werent leaving your home to your direct descendants youd pay nothing on the first 325000 of your estate and 40 on the remaining 200000 meaning a total of 80000 to pay in inheritance tax. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Qualifying estates can continue to pass on up to 500000 and the qualifying.

With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free allowances. In addition the residence nil-rate band will also be frozen at 175000When added to the IHT threshold of 325000 it allows each individual to pass on 500000 with no IHT payable - or 1m per. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year.

The full Budget Speech package is available at the Singapore Budget website. Unsurprisingly given the ongoing pandemic a large part of the Chancellors speech was focused on the continued provision of Government support. Gifts and generation skipping transfer tax exemption amounts are indexed.

APPG suggested changes to the IHT rules. 0704 Wed Mar 3 2021 UPDATED. The Chancellor might change in.

Discover Helpful Information and Resources on Taxes From AARP. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free allowances. The residence nil rate band RNRB was due to start increasing in.

An investor who bought Best Buy BBY in 1990 would have a gain. Posted on 29th April 2021 at 1236. We researched it for you.

The Conservative Manifesto of 2019 ruled out increases in income tax VAT and national insurance and while the Government could argue that Covid changes everything with regards to Inheritance Tax in particular the current Nil rate band of. If there are to be any tax rate rises in order to assist in repaying the huge levels of Government borrowingcopying with a smaller economy they have generally been. The inheritance tax nil rate bands will remain at existing levels until April 2026.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. While there have been no earth shattering changes to the system of Inheritance Tax in the UK. Heng Swee Keat in his Budget Statement for the Financial Year 2021 on Tuesday16 Feb 2021.

The following tax changes were announced by Deputy Prime Minister and Minister for Finance Mr. Inheritance Tax changes. Ad Federal Inheritance Tax Inheritance Tax Estate Tax Federal Estate Tax.

That is only four years away and Congress could still. 20 on assets and property. Even a modest 4 increase in a couples estate valued at 1m could result in additional tax payable of 16000 after 1 year.

Only six states actually impose this tax. Here are our key takeaways from the Autumn Budget 2021 for Inheritance tax. In 5 years time until the end of the nil rate band freeze growth at this level means the same estate would be worth 1216653 which could.

Following the release of Budget 2022 the 3 main thresholds remain as they were as does the rate of tax payable on any amounts inherited in excess of the thresholds. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. The changes in tax rates could be as follows.

Budget 2021 - Overview of Tax Changes. This could result in a significant increase in CGT rates if this recommendation is implemented. Much has been made of the Autumn Budget and the changes around Universal Credit and National Insurance but changes to other taxes are sometimes missed when reviewed by the media.

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

How Do State Estate And Inheritance Taxes Work Tax Policy Center

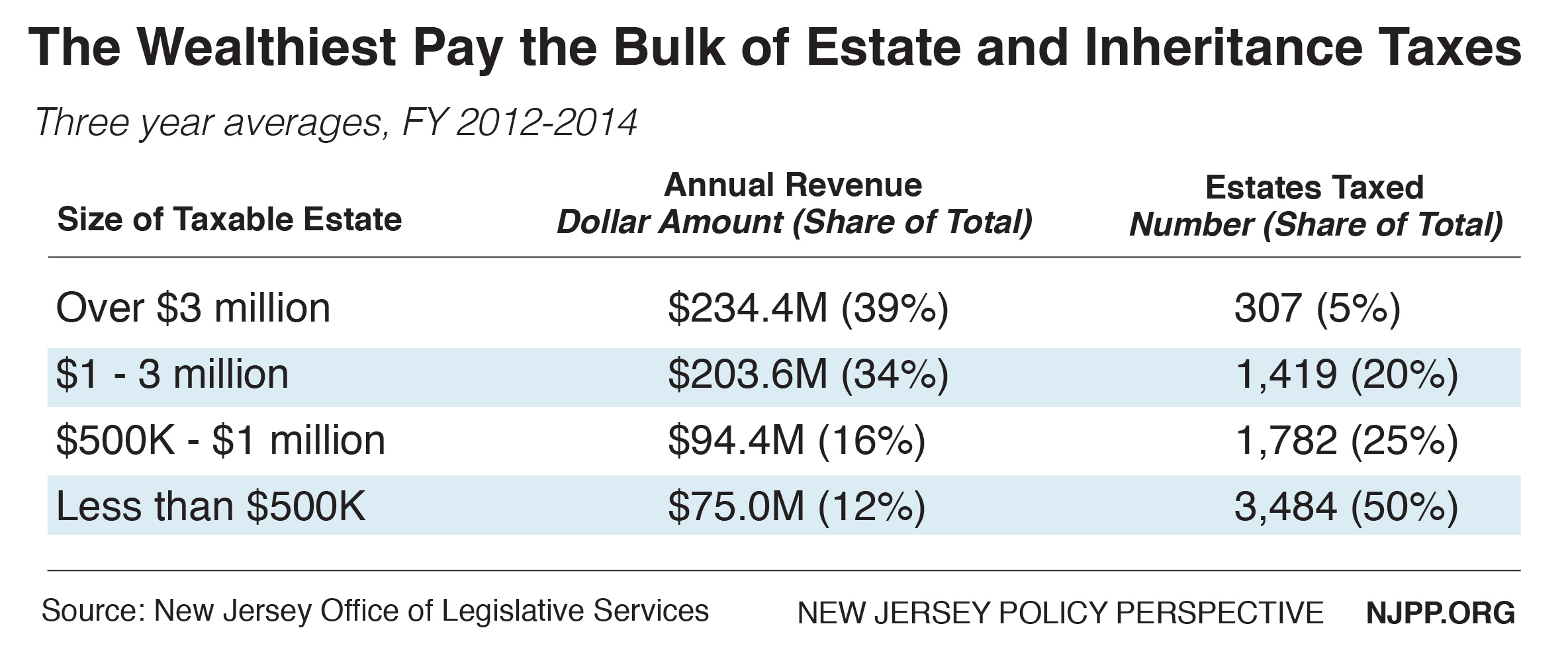

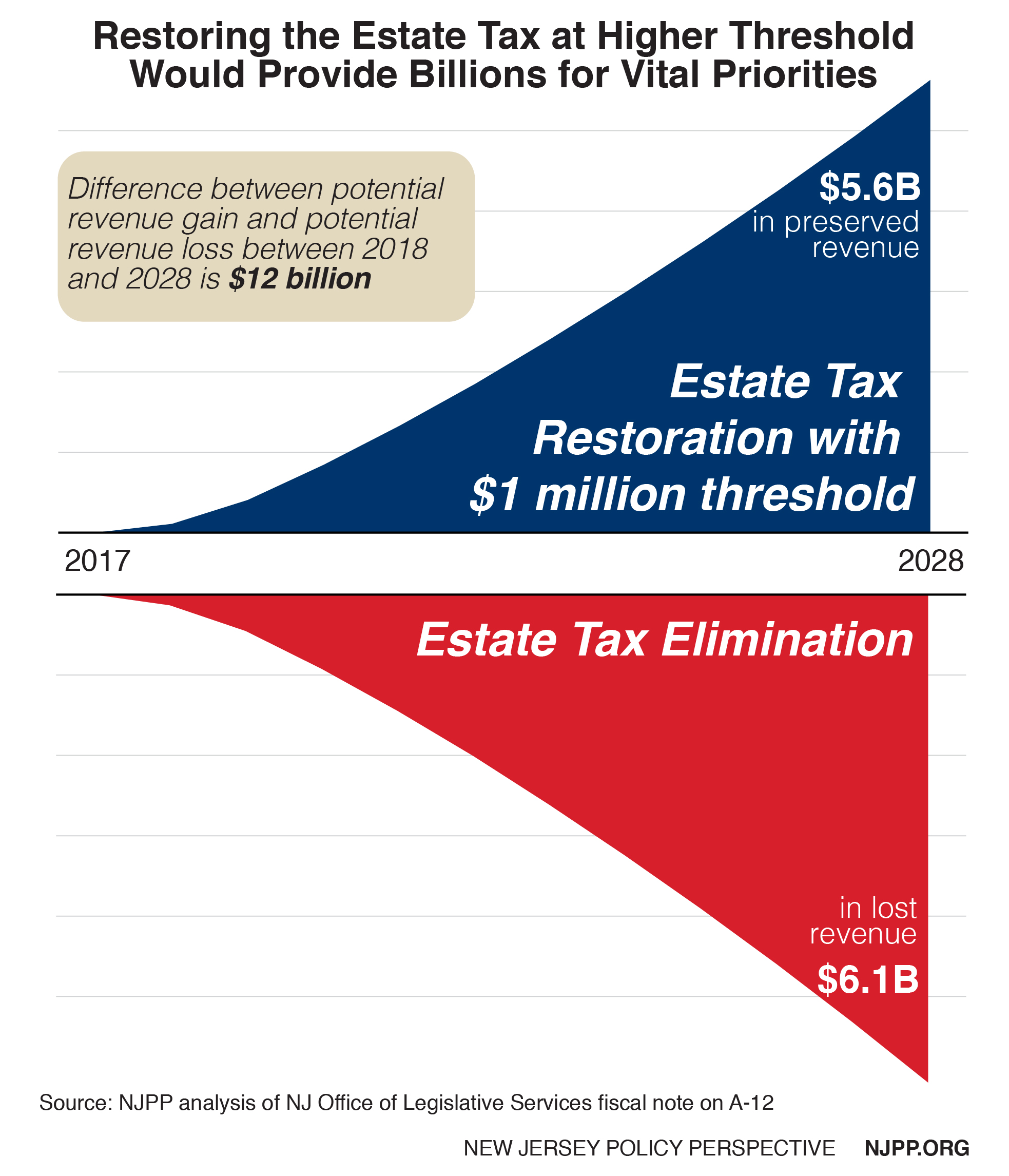

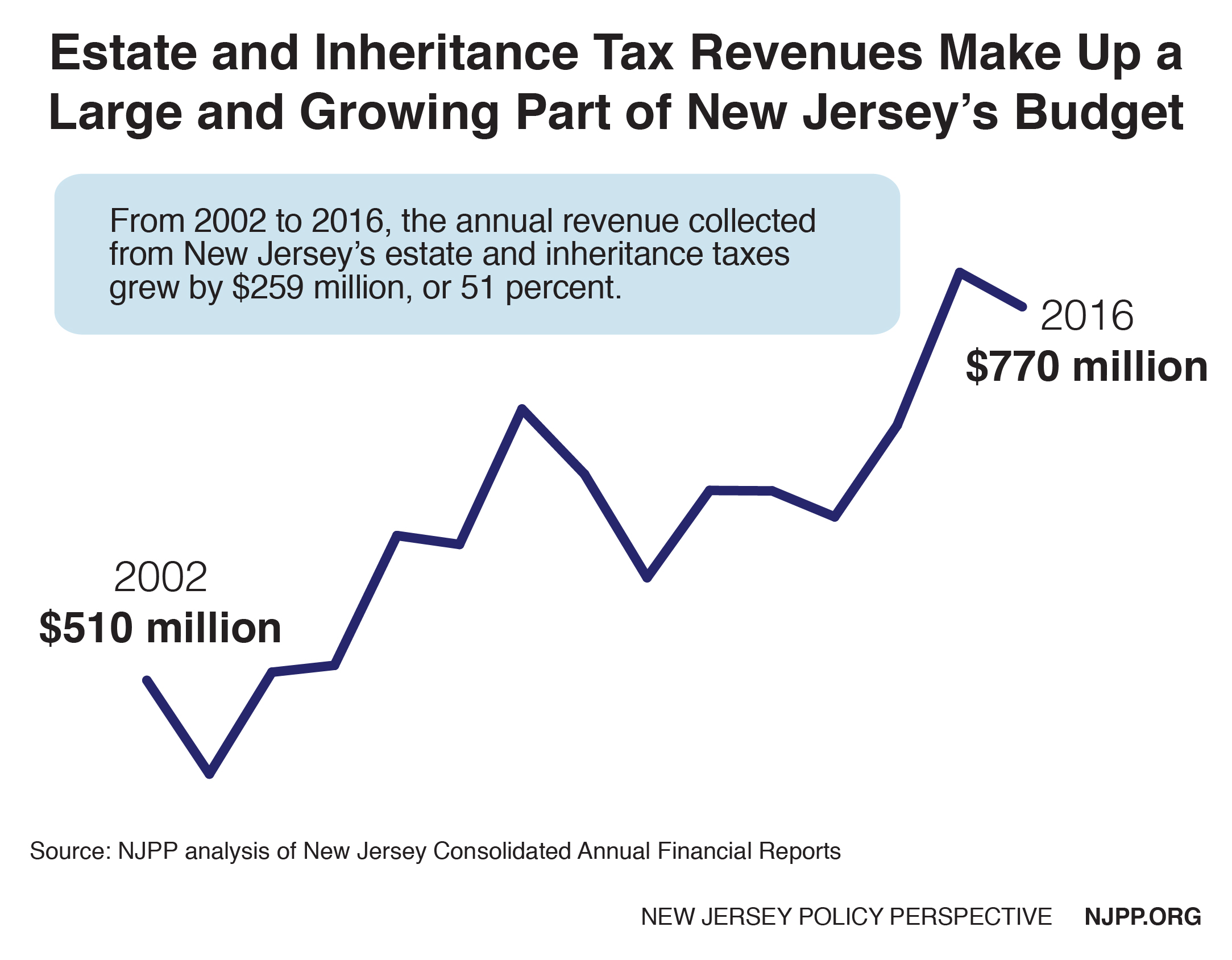

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

A Mortgage Can Easily Become A Lifelong Burden When You Consider That Traditional Mortgages Are Stru Paying Off Mortgage Faster Mortgage Payoff Mortgage Fees

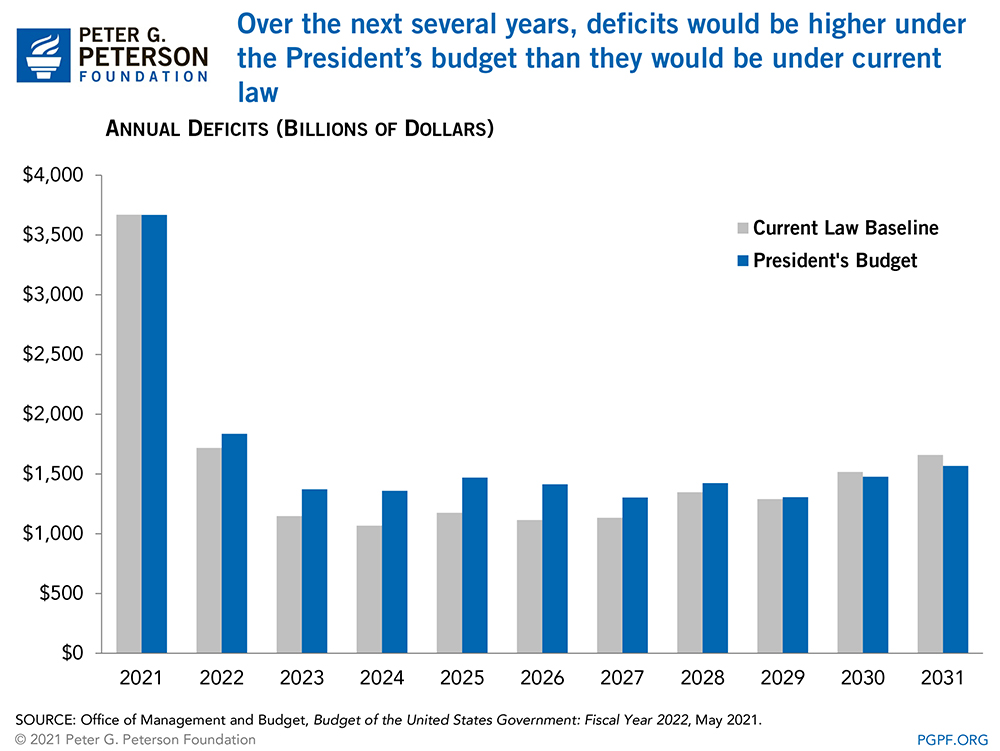

President Biden S Budget Would Pay For New Spending But Doesn T Address The Debt He Inherited

Is There A Federal Inheritance Tax Legalzoom Com

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

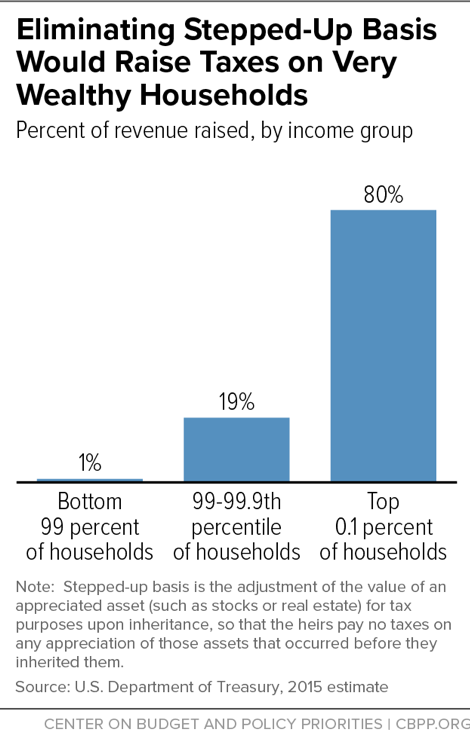

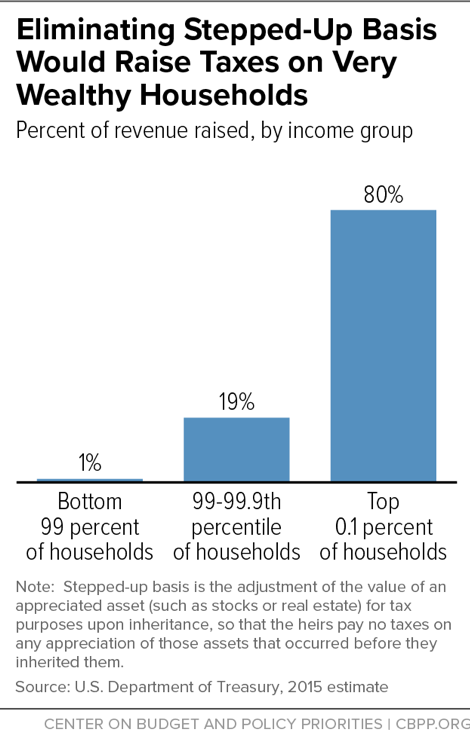

Eliminating Stepped Up Basis Would Raise Taxes On Very Wealthy Households Center On Budget And Policy Priorities

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

Eliminate Iowa S Inheritance Tax Iowans For Tax Relief

2021 Victory Inheritance Tax Eliminated Iowans For Tax Relief

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Personal Finance Is Very Important To Growing Your Wealth Personal Finance Investing Money Life Hacks

Pin On Yaidith Garciga Real Estate

State Death Tax Hikes Loom Where Not To Die In 2021

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Handle An Inherited Ira Eggstack Inherited Ira Ira Simple Ira

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Annual Budget Template Debt Snowball Calculator Personal Finance Bundle Excel Video Video In 2021 Monthly Budget Template Budgeting Budget Spreadsheet